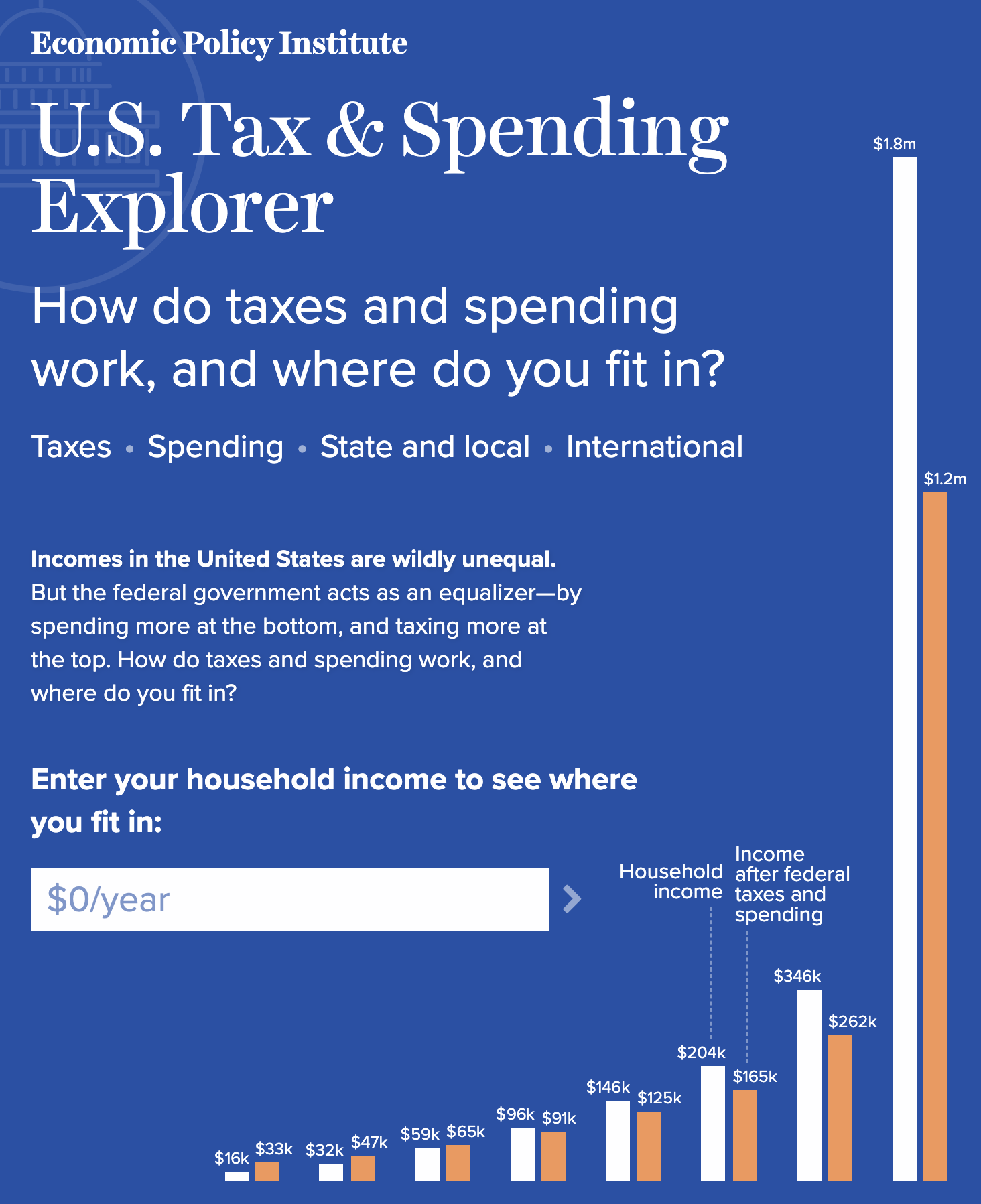

The U.S. federal tax and spending system is the biggest tool to combat inequality, but it could do much more | Economic Policy Institute

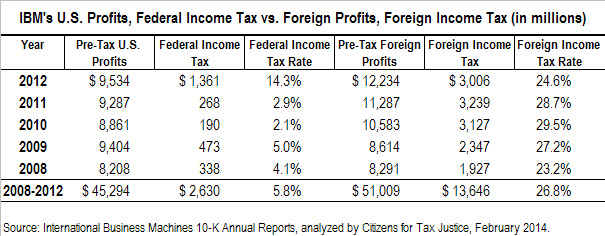

IBM Paid 5.8 Percent Federal Income Tax Rate Over 5 Years | Citizens for Tax Justice - Working for a fair and sustainable tax system

:max_bytes(150000):strip_icc()/irsbldg-57dbf0735f9b586516504856.jpg)